Price Elasticity of Demand: What it Means for Your Business

- Posted in Pricing Strategy

- 15 mins read

In business, every decision a small and medium-sized business (SMB) makes can profoundly impact its success. One crucial aspect that often shapes the destiny of SMBs is how they price their products and services. This is where the concept of “price elasticity of demand” emerges. Price elasticity might sound like a mouthful, but it’s a simple idea with powerful implications.

Imagine you run a local bakery and wonder whether to raise the price of your famous cupcakes. Will your loyal customers still buy them, or will they seek alternatives? This is the heart of price elasticity – understanding how customers react when prices change. And for SMBs, this understanding can be the key to unlocking growth and profitability.

In this article, we will explore the world of price elasticity of demand and focus on how it practically impacts small businesses. From corner stores to online boutiques, understanding price elasticity is like having a secret ingredient that can make or break a business. We’ll unravel this concept in simple terms, showing how it’s much more than an economic theory – it’s a tool that companies can use to make smarter decisions.

Price Elasticity Simplified

Price elasticity of demand might sound like a mouthful, but at its core, it’s all about how people react to price changes. Imagine your favorite snack – if the price increased slightly, would you still buy it as often, or would you cut back? Price elasticity helps us understand this behavior.

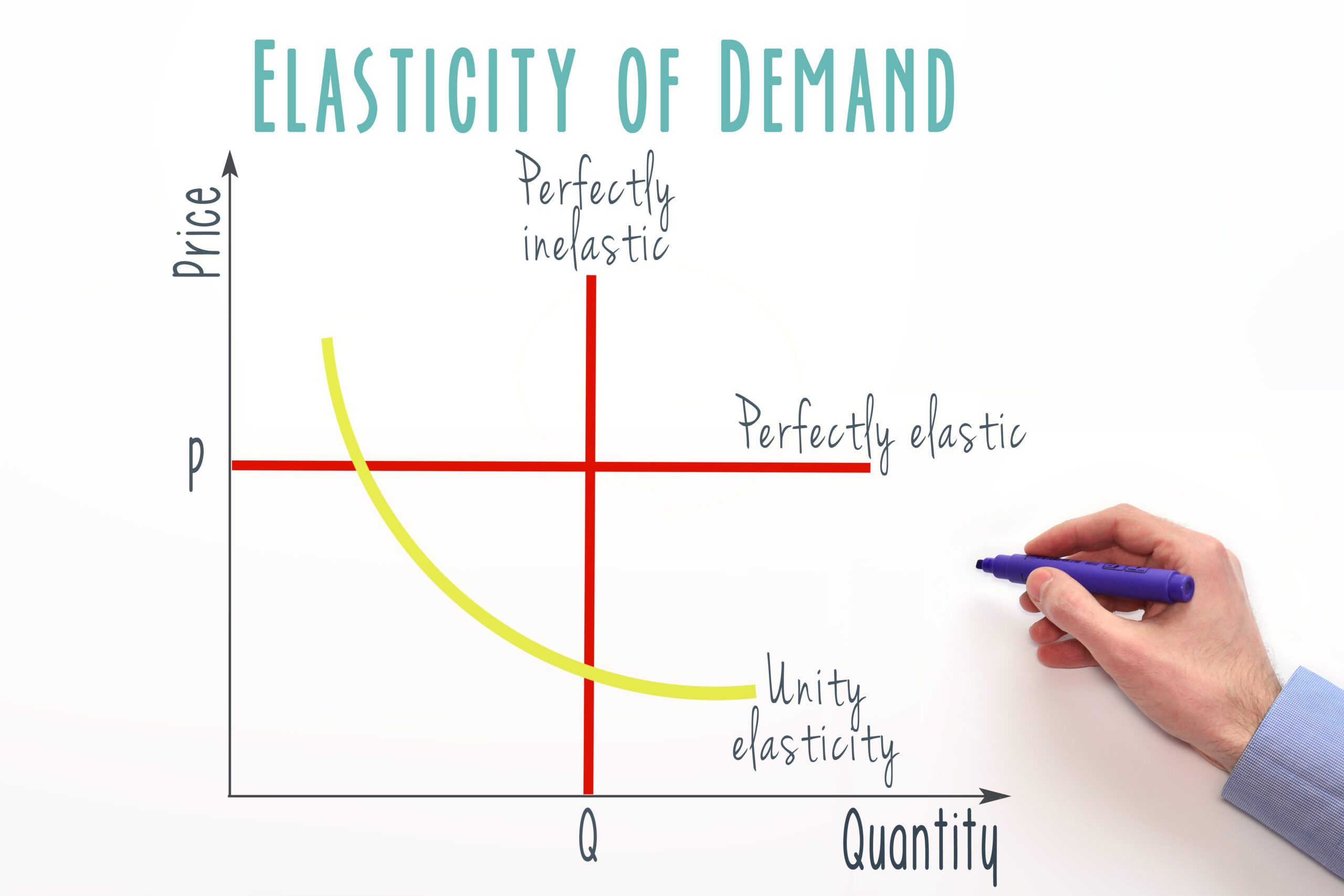

Simply put, price elasticity measures how much the quantity of a product changes when its price changes. If a slight price increase leads to a significant drop in how much people buy, we call that “elastic.” It’s like a rubber band – pulling it just a little stretches a lot. On the other hand, if a price change doesn’t affect how much people buy, it’s called “inelastic.” Picture a rock – no matter how much you push it, it doesn’t change much.

Now, why does this matter for businesses? Well, imagine you’re selling fashionable clothes in your small boutique. If you raise the price of a popular dress, will your customers still flock to buy it? The answer lies in price elasticity. Understanding whether your products are elastic or inelastic can help you make intelligent decisions about pricing, which is crucial for the success of your business.

In this section, we’ll further break down the concept, giving you a clear picture of price elasticity and why it’s a game-changer for small businesses. Whether you’re a business owner trying to determine the best pricing strategy or curious to understand how markets work, this section will lay the foundation for the journey ahead.

Practical Applications for Business

Now that we understand the significance of price elasticity for small businesses let’s explore how this concept comes to life in practical scenarios. Imagine owning a small bookstore and wondering whether to change the prices of your best-selling novels. Price elasticity insights can guide you through this decision-making process.

If your bookstore’s customers are highly responsive to changes in book prices – indicating elastic demand – a slight increase might lead to a notable decrease in sales. In this case, you might keep prices steady or consider offering discounts to keep customers coming. On the other hand, if customers are not significantly affected by price changes – indicating inelastic demand – you might have more flexibility to adjust prices without worrying about losing customers.

Furthermore, price elasticity plays a role in new product development. Let’s say you’re considering introducing a line of premium notebooks in your bookstore. Understanding the elasticity of your target audience helps you set the right price point. If your customer base is elastic, keep prices reasonable to encourage purchases. If inelastic, consider setting a higher price, relying on your customers’ dedication to quality.

Marketing strategies also benefit from price elasticity insights. If you discover that your products have elastic demand, you might emphasize promotions, discounts, and value-added offerings to attract customers looking for good deals. On the other hand, if your products have inelastic demand, you might emphasize the quality and uniqueness of your offerings, focusing on appealing to loyal customers.

In essence, price elasticity is more than just a theory – it’s a practical tool that SMBs can wield to make informed decisions about pricing, product development, and marketing strategies. Businesses can tailor their approaches to maximize revenue and customer satisfaction by understanding how sensitive their customers are to price changes. In the following sections, we’ll delve into methods SMBs can use to measure or estimate price elasticity, giving them the tools they need to thrive in their business ventures.

Factors Affecting Price Elasticity

The concept of price elasticity of demand isn’t just about numbers; it’s influenced by various real-world factors that shape how customers respond to price changes. Understanding these factors is crucial for businesses seeking to make informed decisions about their pricing strategies.

Availability of Substitutes: When customers have readily available substitutes for a product, they are more likely to be sensitive to price changes. If the price of one brand’s product increases, customers might switch to a similar product. This leads to higher elasticity, as the price change significantly impacts demand.

Necessities vs. Luxuries: The nature of the product also plays a role in its elasticity. Essentials like food, medicine, and basic utilities often have inelastic demand, as customers need them regardless of price changes. On the other hand, luxury items like designer clothes or high-end gadgets might have more elastic demand, as customers can easily forego them if prices increase.

The proportion of Income Spent: If a product constitutes a large portion of a customer’s income, they are likely to be more sensitive to price changes. For example, a significant gas price increase can lead to a substantial decrease in demand, as it affects consumers’ overall budgets.

Time Horizon: The elasticity of demand can also change over time. Customers might be less responsive to price changes in the short term, as they need time to adjust their consumption habits. However, as consumers explore alternatives and adapt in the long term, demand elasticity might increase.

Brand Loyalty: Strong brand loyalty can lead to inelastic demand. Customers deeply attached to a brand might continue purchasing even if prices rise, as their commitment outweighs the impact of price changes. This is often seen in products with a strong emotional connection to customers.

Market Definition: How you define the market for your product can influence its elasticity. For example, if you narrowly define the market, the elasticity might be higher, as customers have more alternatives. On the other hand, a broader market definition might result in lower elasticity.

Perceived Necessity: Customers might be less responsive to price changes if they perceive a product as necessary for their well-being or daily life. This is particularly relevant for products with a strong cultural or social significance.

Income Distribution: The distribution of income in a market can impact price elasticity. In markets with a wide income disparity, higher-income individuals might have inelastic demand for luxury goods, while lower-income individuals might have elastic demand for essential products.

These factors create a complex tapestry that influences how customers react to price changes. By considering these elements, businesses can better understand their target audience and tailor their pricing strategies accordingly. As the interplay of these factors continues to shape market dynamics, companies that grasp the intricacies of price elasticity can navigate pricing complexities with precision and strategic foresight.

Measuring Price Elasticity for SMBs

Now that we know how price elasticity influences small businesses let’s explore the methods SMBs can use to measure or estimate this concept. Think of these methods as tools in your toolbox that can help you decipher how your customers react to price changes.

One method is the “Percentage Change Method.” This involves calculating the percentage change in quantity demanded due to a percentage change in price. If the calculated percentage is greater than 1, your product is elastic – meaning customers are quite responsive to price changes. If it’s less than 1, it suggests your product is inelastic – price changes don’t affect demand as much.

Another tool is the “Midpoint Formula.” This method considers the average of the initial and final prices and quantities to calculate the elasticity. It’s particularly useful when dealing with significant changes in price or quantity. Like the Percentage Change Method, an elasticity value above 1 denotes elasticity, while a value below 1 indicates inelasticity.

Real-world examples are also valuable resources. You can estimate elasticity by looking at your past sales data and observing how your customers reacted to price adjustments. For instance, if you lower the price of a product and see a substantial increase in sales, it suggests elastic demand – customers are responding positively to the price change.

Conducting market research and surveys is another valuable tool. Directly engaging with your customers can provide insights into their responsiveness to price changes. You can gauge whether your products have elastic or inelastic demand by asking questions about how they would react to different price scenarios. This information is like a compass guiding you toward pricing strategies that align with customer preferences.

The Ever-Evolving Nature of Price Elasticity

In the business world, change is the only constant, and the concept of price elasticity of demand is no exception. As markets shift, consumer preferences evolve, and economic conditions change, the nature of price elasticity can transform over time.

Consider the example of a small bakery. In the past, their artisanal pastries might have had inelastic demand – customers were loyal and didn’t mind paying a bit extra. However, as health-conscious trends emerged, customers started seeking healthier alternatives, causing the demand for their pastries to become more elastic. The bakery had to adapt by introducing healthier options or adjusting prices to remain competitive.

External factors can also influence price elasticity. Economic recessions can make customers more price-sensitive, turning previously inelastic products into elastic ones. Similarly, shifts in consumer tastes or technological advancements can reshape demand patterns, impacting how customers respond to price changes.

Monitoring price elasticity over time is essential. Just as you wouldn’t navigate a changing landscape with an outdated map, businesses must regularly assess their products’ elasticity. This allows them to fine-tune their pricing strategies, remain relevant, and meet customer expectations.

In essence, the ever-evolving nature of price elasticity underscores the need for constant vigilance and adaptability. Businesses that recognize this fluidity and stay attuned to market shifts are better equipped to make timely decisions that ensure their products remain appealing and competitive. As you continue your journey in the business world, remember that understanding and navigating the changing nature of price elasticity is an essential skill for long-term success.

Real-World Examples of Small Businesses Using Price Elasticity

To truly grasp the practical impact of price elasticity on small businesses, let’s journey into real-world scenarios where SMBs have harnessed this concept to their advantage. These stories showcase how price elasticity isn’t just a theory – it’s a tool that can shape the fate of businesses in tangible ways.

Imagine a local ice cream parlor facing a dilemma. They’re contemplating raising the price of their famous sundaes. By analyzing their sales data and understanding their customers’ sensitivity to price changes, they realize that their ice cream has inelastic demand – customers will indulge in their sundaes even if the price goes up. With this insight, the parlor confidently adjusts its prices, knowing loyal customers won’t be discouraged.

On the flip side, let’s consider a small electronics store. They’ve noticed that sales of a particular gadget have been declining. Digging deeper, they find that the product has elastic demand – a slight price increase has led to a significant drop in sales. Armed with this knowledge, the store decided to lower the price slightly, attracting back customers who were deterred by the higher cost.

Moving beyond products, services can also benefit from price elasticity insights. Think of a local gym aiming to increase membership. By understanding that their potential customers are sensitive to pricing, they offer limited-time discounts and special offers. These promotions tap into the elasticity of their target audience, enticing more people to sign up.

These real-world examples underline the versatility of price elasticity for SMBs. Whether it’s adjusting product prices, launching promotions, or understanding the best time to introduce new offerings, this concept serves as a guiding light. As we move forward, you’ll gain insights into applying these lessons to your business, enabling you to navigate pricing strategies confidently and precisely.

Navigating Challenges and Maximizing Benefits

While price elasticity of demand offers valuable insights to small businesses, it’s essential to acknowledge that applying these insights isn’t always a walk in the park. Understanding the challenges and considerations associated with this concept is vital to making informed decisions that yield positive outcomes.

One challenge SMBs might face is obtaining accurate data. To measure price elasticity effectively, you need precise information about price changes and corresponding changes in sales. Any inaccuracies in these data points can lead to flawed calculations and misleading interpretations of customer behavior.

External factors can also play a role in the accuracy of elasticity calculations. Economic changes, shifts in consumer preferences, or unexpected events can disrupt the usual demand patterns. For example, during economic downturns, even products with inelastic demand might experience reduced sales due to financial constraints.

Furthermore, the nature of elasticity is not set in stone. As markets evolve and consumer behavior shifts, elasticity values can change over time. This means SMBs must regularly reassess their pricing strategies to remain aligned with changing dynamics.

Another consideration is striking the right balance when applying price elasticity insights. While adjusting prices based on elasticity can be profitable, extreme changes can have unintended consequences. For instance, drastically lowering prices for inelastic products might lead to perceptions of lower quality.

While price elasticity of demand offers valuable insights, it’s not a magic bullet. SMBs must overcome challenges related to data accuracy, external influences, changing dynamics, and finding the proper equilibrium. By acknowledging these considerations and using elasticity as a guiding tool rather than an absolute answer, Small businesses can harness their potential to make well-informed decisions that contribute to long-term success. As you move forward, knowing these challenges will empower you to navigate the complexities of pricing strategies confidently.

Leveraging Price Elasticity as an SMB Strategy

In the small business world, crafting a successful strategy requires a blend of insight, adaptability, and innovation. Price elasticity of demand serves as a valuable ally for SMBs, guiding them in making strategic decisions that resonate with customers, maximize revenue, and establish a competitive edge.

Small businesses can leverage price elasticity insights by tailoring their pricing strategies to their customer base. Imagine running a boutique clothing store and discovering that your products have elastic demand. This means customers are quite responsive to price changes. In response, you might opt for frequent sales, discounts, or special offers to attract shoppers seeking good deals. By aligning your pricing strategy with the elasticity of your products, you can tap into customer behavior and drive higher foot traffic.

Conversely, if your products have inelastic demand, indicating that customers are less influenced by price changes, you might emphasize the quality and exclusivity of your offerings. Highlighting the unique features and benefits can justify a higher price point. This strategy can cultivate customer loyalty and lead to increased profit margins.

Moreover, price elasticity insights can inform product development and diversification strategies. Imagine you operate a local bakery and want to introduce a line of premium pastries. Understanding the elasticity of your target audience can guide you in pricing these items to strike a balance between premium quality and customer affordability. This approach can position your business as a destination for both quality-conscious and budget-conscious consumers.

The Price Elasticity Advantage: A Recap

As we draw the curtain on our exploration of price elasticity of demand, let’s take a moment to recap the key insights and advantages this concept offers to small businesses.

Price elasticity, in its essence, is all about understanding how customers respond when prices change. Whether a product is elastic – where small price changes lead to significant shifts in demand – or inelastic – where price changes have less impact – this knowledge forms the foundation of intelligent pricing strategies.

For small businesses, price elasticity is a compass that guides decisions across various fronts. It helps adjust prices effectively, striking the right balance between attracting customers and maximizing revenue. This insight becomes particularly important when considering discounts, promotions, and pricing adjustments to stay competitive.

Moreover, the concept of price elasticity extends beyond pricing alone. It influences product development decisions, as understanding customer sensitivity to price changes aids in determining the value your products provide. Marketing strategies also gain from elasticity insights, enabling businesses to tailor their approaches based on customer responsiveness to price fluctuations.

Yet, the journey doesn’t end with a simple calculation of elasticity. External factors, market shifts, and customer preferences are all dynamic forces that require constant vigilance and adaptation. As the world changes, so does the elasticity of your products, making ongoing analysis a necessity for businesses aiming for sustained success.

The advantage of embracing price elasticity is clear – it empowers small businesses to navigate the complexities of pricing, products, and marketing strategies with precision and confidence. By incorporating this knowledge into their decision-making processes, companies can thrive in competitive markets, connect with customers, and build a foundation for long-term growth and prosperity.

Share with: