How to Budget Your Business Balance Sheet

- Posted in Budgeting

- 12 mins read

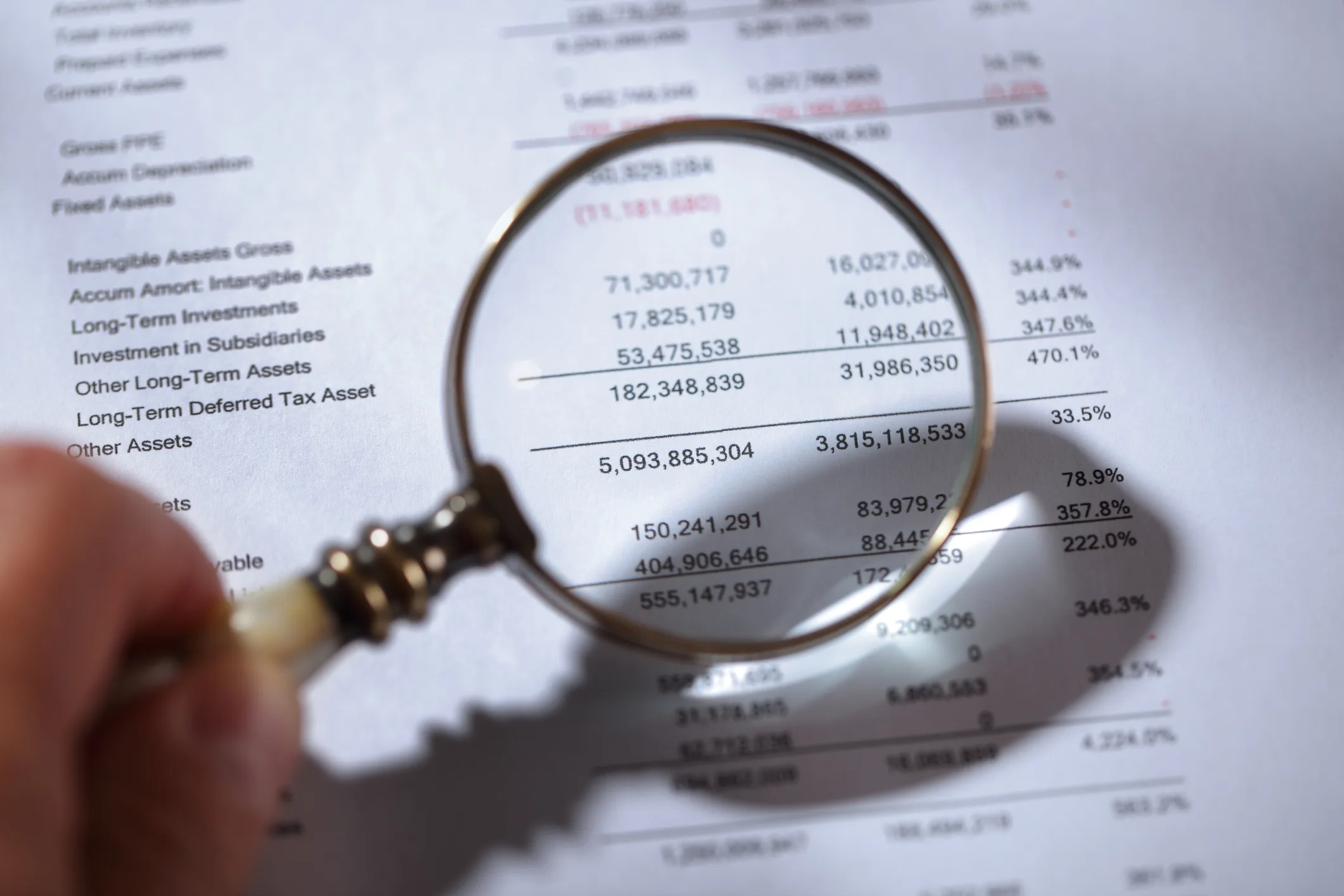

When running a business, the ability to plan and forecast is a necessity. While many business owners meticulously budget for their Profit & Loss (P&L) and capital spending, the balance sheet is an often overlooked but equally important financial statement to budget. Understanding and effectively budgeting your balance sheet can help secure your business’s financial health.

A balance sheet provides a snapshot of a company’s financial position at a given time. It reflects the assets your business controls, the liabilities it owes, and the equity invested. However, beyond its role in financial reporting, a balance sheet can serve as a strategic tool, offering insights into the company’s operational efficiency, liquidity, and overall financial stability.

This article explains creating a budget for your business balance sheet. We will explore why a balance sheet budget is a must-have in your financial toolkit. By the end of this guide, you will understand how the balance sheet can play a pivotal role in forecasting your business’s future financial position.

This article is part one of a two-part series. In the next article, we will show you how to budget your Statement of Cash Flows and complete your comprehensive financial plan.

The Need for a Balance Sheet Budget

Budgeting in business often focuses on the more immediate, operational aspects of financial planning, like Profit & Loss (P&L) and capital expenditures. However, the creation of a budget for your balance sheet is equally important. This section delves into why a Balance Sheet Budget is crucial and how it complements your P&L and capital budgets.

Why a Balance Sheet Budget?

A Balance Sheet Budget is a forward-looking tool that forecasts the expected financial position of your business in the future. It shows you where your business is headed. This budget helps predict your business’s future financial health, providing a comprehensive picture that includes assets, liabilities, and equity.

- Predictive Power: It acts as a financial crystal ball, giving you foresight into potential liquidity challenges, investment opportunities, and the ability to meet short-term and long-term obligations.

- Strategic Decision Making: With this budget, you can plan for growth, anticipate the need for additional financing, or prepare for strategic shifts in your business model.

The Link Between P&L, Capital Budgets, and the Balance Sheet

Understanding the connection between your P&L, capital budgets, and the balance sheet is helpful. The balance sheet is, in many ways, a reflection of the other two:

- Derived from P&L and Capital Budgets: Most elements of the balance sheet are direct outcomes of your P&L and capital spending decisions. For instance, your revenue and expenses (P&L) influence your cash and receivables, while your capital expenditures affect your assets and, potentially, your liabilities.

- Complementary Relationship: The balance sheet fills in the gaps left by the P&L and capital budgets. While the P&L shows profitability, the balance sheet highlights the business’s solidity, revealing how effectively the profits are being used and managed.

Simplifying the Process

Many business owners may feel daunted by the prospect of creating another budget. However, once you have a P&L and capital budget, much of the groundwork for a balance sheet budget is already done.

- Leveraging Existing Data: Since many balance sheet accounts are based on P&L and capital expenditure outcomes, much of the data needed for a balance sheet budget will be drawn from these existing documents.

- Streamlining the Budgeting Process: By integrating the budgeting processes, you save time and ensure consistency across your financial planning.

A Balance Sheet Budget is vital to a comprehensive financial planning process. It builds upon the data and insights from your P&L and capital budgets, offering a future-oriented view of your business’s financial health. In the next section, we’ll guide you through the practical steps of creating a Balance Sheet Budget, helping you to turn this conceptual understanding into an actionable financial strategy.

Steps to Budget a Balance Sheet

Creating a budget for your balance sheet is a critical step in comprehensive financial planning for your business. This section outlines the practical steps to build an effective balance sheet budget.

A. Starting with the Current Balance Sheet

Begin by taking your business’s most recent balance sheet. This document will serve as the foundation for your projections.

- Alignment with P&L Budget Period: Ensure that the starting point of your balance sheet budget corresponds with the start of your P&L budget period. This alignment is crucial for consistency and accuracy in your financial projections.

B. Integrating the P&L Budget

The next step involves incorporating the insights from your P&L budget into the balance sheet budget.

- Net Income to Retained Earnings: Add the net income projected in your P&L budget to the retained earnings in your balance sheet. This step reflects how your business’s profitability impacts its equity.

- Impact on Working Capital: Adjust the working capital accounts in your balance sheet based on the expected changes in your P&L. Working capital accounts are short-term assets and liabilities that arise from differences in the timing of business activity and cash payments. This includes accounts like receivables, inventory, and payables.

C. Understanding and Adjusting Working Capital Accounts

Working capital accounts are a key component of your balance sheet and include accounts receivable, inventory, and accounts payable.

- These are ‘Spontaneous Accounts‘: Accounts that naturally change with the business’s operations. For example, as sales increase, so typically do accounts receivable and inventory.

- Historical Analysis: Look at past relationships between these working capital accounts and relevant P&L components. For instance, you might analyze accounts receivable as a percentage of revenue. This historical perspective helps in making informed projections. Once you understand these relationships, you can project the working capital accounts based on the P&L budget.

D. Tailoring the Working Capital Analysis to Your Business

The specifics of your business will dictate the period of P&L data you should consider for your balance sheet budgeting.

- Consider Payment Cycles: If customers typically pay within 90 days, analyze past accounts receivable balances as a percentage of the prior three months of sales.

- Expect Variability: There will be some variability in the past data. You are not likely to see the same percentage or ratio between accounts for every period. Focus on arriving at a reasonable best estimate based on average historical relationships.

E. Capital Expenditures and Depreciation

If your business plans to make capital expenditures, these must be reflected in your balance sheet budget.

- Accounting for New Assets and Depreciation: Add planned capital spending to the fixed asset accounts. Simultaneously, account for projected depreciation from your P&L Budget in the accumulated depreciation accounts.

F. Managing Debt and Equity Changes

Adjustments for debt and equity are crucial for an accurate balance sheet budget.

- Debt Repayment and Acquisition: If you’re paying down debt, update the liability account according to your loan’s amortization schedule. For new debt, add the expected amount to your liabilities.

- Equity Adjustments: Reflect any planned distributions to owners or additional equity investments in the equity accounts.

G. Finalizing the Cash Balance

The cash balance is the final piece of the puzzle in your balance sheet budget.

- Calculating Cash Balance: This equals total liabilities plus total equity minus the other asset accounts. The balance sheet needs to balance.

- Logical Consistency: This calculation makes sense mathematically and logically. Changes in the other accounts represent cash movements or the delay of cash movements. The change in the cash balance is the net result of all these movements.

You will have constructed a comprehensive balance sheet budget by following these steps. This budget provides a clear picture of your expected financial position and ensures that all aspects of your financial planning are interconnected and aligned.

In the next section, we will explore how to interpret and utilize this budgeted balance sheet to enhance your business’s financial health and strategic decision-making. By effectively applying these budgeting steps, you can proactively manage your business’s economic future, identifying potential risks and opportunities well in advance.

Learn More: Understanding Accrual Accounting: A Step-By-Step Guide

A Comprehensive Snapshot of Your Financial Health

Having completed the steps to create a budgeted balance sheet, you now hold a powerful tool that offers a glimpse into the future financial health of your business. This section explores how to interpret and utilize this budgeted balance sheet for strategic planning and risk management.

Interpreting the Budgeted Balance Sheet

Your budgeted balance sheet is a narrative of your business’s financial direction.

- Understanding Liquidity and Solvency: Assess your business’s projected liquidity (ability to meet short-term obligations) and solvency (ability to meet long-term commitments). This understanding is crucial for ensuring operational stability.

- Evaluating Asset Management: Look at how effectively your assets are used. For example, are high receivables indicative of lax credit policies? Is too much capital tied up in inventory?

- Debt Management: Analyze your debt levels and repayment plans. How do these align with your cash flow projections and income forecasts?

Strategic Decision-Making Based on Projections

The insights gained from your budgeted balance sheet can drive strategic business decisions.

- Anticipating Financing Needs: If your budget indicates potential cash shortfalls, you can plan for additional financing or adjust operations to improve cash flow.

- Planning for Growth: Understanding your financial position allows for more informed decisions regarding expansion, investment in new projects, or entering new markets.

- Risk Mitigation: Identify potential financial risks early, such as over-leveraging or liquidity crunches, and develop strategies to mitigate these risks.

Balancing Estimates and Reality

While a budgeted balance sheet is a projection, balancing these estimates with real-world contingencies is essential.

- Flexibility is Key: Recognize that a budget is based on assumptions and estimates. Be prepared to adjust your plans as actual figures and market conditions change.

- Regular Review and Adjustment: Make it a practice to compare your budgeted figures with actual results regularly. This will improve the accuracy of future budgets and keep your financial strategies aligned with the current business environment.

- Learning from Variances: Analyze variances between the budgeted and actual figures to understand why they occurred. This analysis can provide valuable insights into your business operations and financial management practices.

Proactive Financial Management

With a budgeted balance sheet, you are better equipped to manage your business proactively rather than reactively.

- Forward-Looking Approach: Instead of just reviewing past performance, you can now anticipate future financial conditions and plan accordingly.

- Empowered Decision Making: Armed with a clearer understanding of your financial trajectory, you can make more confident and informed decisions that align with your business goals.

Your budgeted balance sheet is vital to your business’s financial planning arsenal. Providing a detailed projection of your company’s financial position empowers you to make proactive, strategic decisions that can steer your business toward long-term success and stability. The next and final section will conclude with key takeaways and emphasize the importance of integrating a balance sheet budget into your regular financial planning process.

Conclusion

Creating and interpreting a balance sheet budget are strategic endeavors that can significantly influence the course of your business.

Recap of Key Insights

- Comprehensive Financial Planning: A balance sheet budget is essential to a well-rounded financial plan, working in tandem with your P&L and capital budgets.

- Predictive Tool for Future Health: This budget serves as a forward-looking tool, providing a snapshot of your business’s potential future financial position.

- Strategic Decision-Making: The insights gained from a balance sheet budget enable informed decisions about financing, growth, and risk management.

The Strategic Importance of Balance Sheet Budgeting

Incorporating a balance sheet budget into your financial planning process can elevate your business strategy.

- Holistic View of Financial Health: It encourages a broader perspective of your company’s financial status beyond mere profitability.

- Proactivity Over Reactivity: This approach shifts your management style from reacting to past events to proactively planning for future scenarios.

- Empowering Business Growth: Understanding your financial standing in depth can guide strategic decisions that fuel sustainable growth.

As a business owner or financial manager, embracing the practice of balance sheet budgeting is a strategic imperative.

- Start Budgeting Now: If you haven’t already, integrate a balance sheet budget into your regular financial planning cycle.

- Embrace Continuous Learning: The budgeting process is iterative and evolves with your business. Embrace each cycle as an opportunity to deepen your financial acumen.

- Seek Expertise When Needed: Don’t hesitate to consult with financial experts to refine your approach and ensure the accuracy and effectiveness of your budgeting practices.

Final Thoughts

Mastering balance sheet budgeting is an ongoing and dynamic effort. It reflects the ever-changing nature of business itself. By committing to this practice, you are not only ensuring the financial health of your business but are also paving the way for informed decision-making, strategic growth, and long-term success.

In business, the power of foresight cannot be underestimated. A well-crafted balance sheet budget is your compass through the financial landscape of your business, helping you navigate challenges and seize opportunities with confidence.

Share with: