How to Budget Your Statement of Cash Flows

- Posted in Budgeting

- 11 mins read

In business management, anticipating and planning for the future is as important as understanding the present. The budgeted Statement of Cash Flows (SCF) is an effective tool for this foresight. While many business owners are familiar with the SCF as a historical financial report, its potential as a forward-looking budgeting tool is often underutilized.

The budgeted SCF is pivotal in strategic financial planning, offering a detailed projection of cash inflows and outflows. This projection is not just about predicting the future; it’s about preparing for it. By understanding how and why to create a budgeted SCF, business owners can better understand their company’s future financial health, enabling them to make informed decisions today that will impact tomorrow.

This article explains the process of creating a budgeted Statement of Cash Flows. We’ll demonstrate its value in business management and then show how it is constructed as a reorganization of balance sheet information. This understanding simplifies the process, as the hard work is primarily in assembling the balance sheet. We’ll walk through the steps to create the budgeted SCF, clarify the nature of positive and negative cash flows, and discuss the invaluable insights a projected SCF provides for managing and growing your business.

This article is part two of a series. If you have not yet prepared a balance sheet budget, learn how in part one.

The Value of Budgeting for the Statement of Cash Flows

Budgeting for the Statement of Cash Flows (SCF) is not just an accounting exercise; it’s a strategic tool that offers insights into the financial future of your business. Here’s why it’s invaluable:

Proactive Financial Management:

- Anticipating Cash Needs: A budgeted SCF allows you to foresee periods of cash surplus or shortage, helping you plan accordingly. This foresight is crucial for maintaining liquidity and avoiding financial distress.

- Strategic Decision Making: With a clear view of expected cash flows, you can make informed decisions about investments, expansions, or other significant financial commitments.

- Performance Tracking: Comparing actual cash flows against budgeted figures helps identify areas where the business is over-performing or underperforming, allowing for timely adjustments.

Improved Stakeholder Communication:

- Investor and Lender Confidence: A well-prepared budgeted SCF can boost the confidence of investors and lenders in your business’s financial management capabilities.

- Internal Clarity: It also gives your management team and employees a clear picture of the company’s financial trajectory, aiding in alignment and goal setting.

The value of a budgeted SCF lies in its ability to turn financial data into actionable insights, guiding businesses toward better financial health and strategic growth. Next, we’ll explore how the SCF essentially reorganizes balance sheet information, simplifying its creation process.

Understanding the Statement of Cash Flows as a Reflection of the Balance Sheet

Grasping the relationship between the balance sheet and the Statement of Cash Flows (SCF) simplifies creating a budgeted SCF. Here’s how these financial statements are interconnected:

The Balance Sheet as the Foundation:

- Basis for the SCF: The balance sheet provides the starting point for the SCF. It’s a snapshot of a company’s financial position at a specific point in time, including its cash balance.

- Linking Balance Sheet and SCF: Changes in the balance sheet accounts over a period directly influence the cash flow, as reflected in the SCF.

Calculating Net Cash Flow:

- Determining Net Change: The net cash flow in a given period is determined by the difference between the balance sheet’s opening and closing cash balances.

- The Principle of Balance: Since the balance sheet adheres to the accounting equation (Assets = Liabilities + Equity), the changes in these elements are inherently linked to changes in cash.

Reorganizing Balance Sheet Data into Cash Flow:

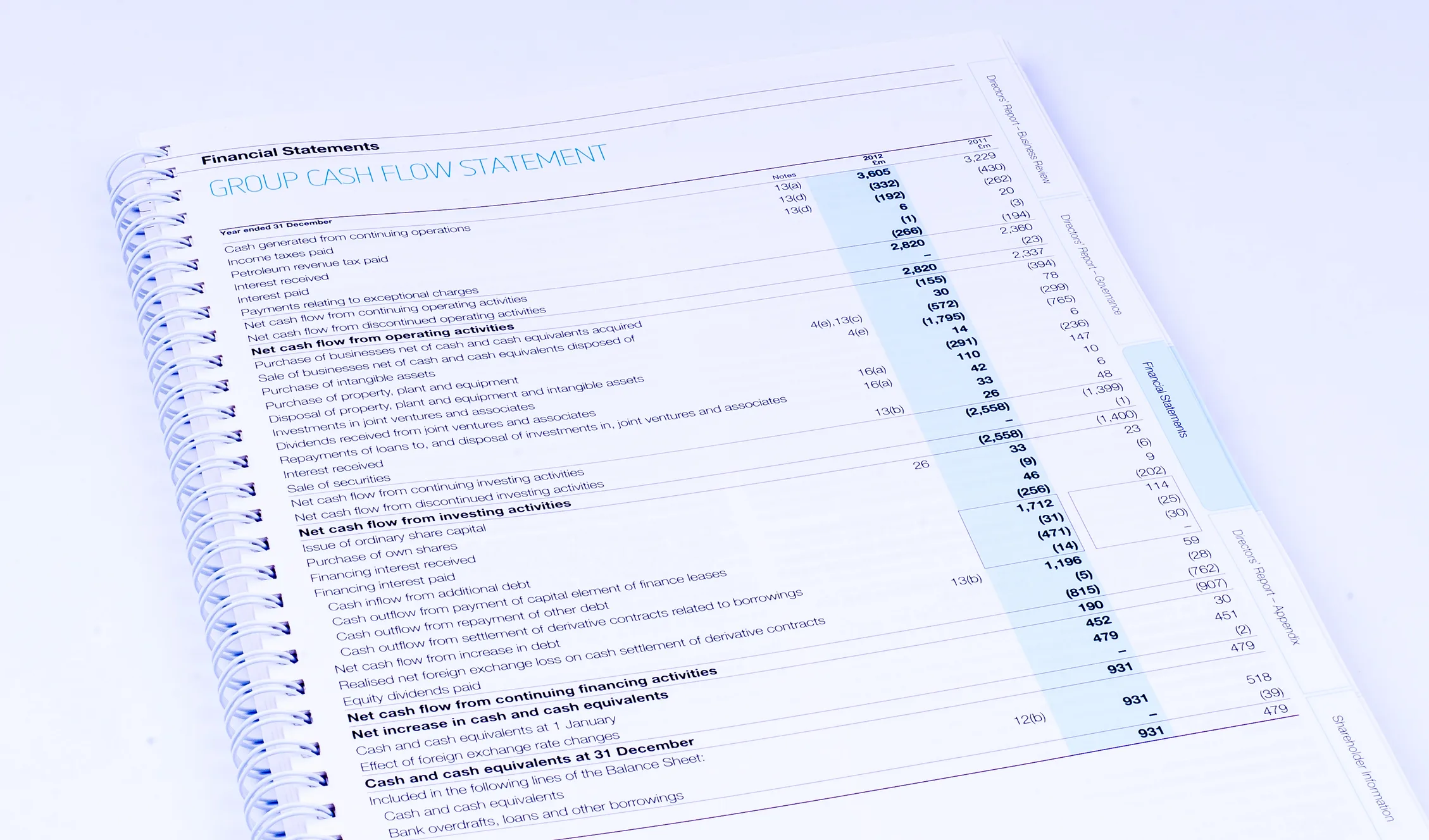

- Categorizing Changes: The SCF reorganizes changes in balance sheet accounts into cash flows from operating, investing, and financing activities. This categorization provides a clearer understanding of how cash is moving within the business.

- Telling the Cash Flow Story: By tracing how each balance sheet account contributes to the overall cash position, the SCF narrates the financial story of a business, focusing on its liquidity and cash management.

Understanding the relationship between the balance sheet and the SCF helps project future cash flows. This insight simplifies creating a budgeted SCF, as it becomes a matter of translating balance sheet projections into a cash flow narrative. Next, we will delve into the step-by-step process of constructing a budgeted Statement of Cash Flows, guiding you through each component to ensure a comprehensive financial forecast.

Learn More: Understanding Accrual Accounting: A Step-By-Step Guide

Steps to Create the Budgeted Statement of Cash Flows

Creating a budgeted Statement of Cash Flows (SCF) systematically translates balance sheet projections into a comprehensive cash flow forecast. Here’s a step-by-step guide:

A. Starting with Net Income:

- Net Income as the Starting Point: The first line in the SCF is usually the net income derived from the projected income statement.

- Link to Retained Earnings: This figure correlates with changes in retained earnings on the balance sheet, forming the starting point for the SCF.

B. Convert to Operational Cash Flow:

- Non-Cash Transactions: Adjust net income for non-cash items like depreciation, which affect profits but not actual cash flow. The balance sheet shows this as the change in accumulated depreciation.

- Changes in Working Capital Accounts: Analyze the projected changes in accounts like receivables, inventory, and payables. This adjusts net income to actual cash flow from operating activities.

C. Addressing Investing Cash Flow:

- Fixed Asset Account Changes: Projected purchases or sales of fixed assets are reflected in this section. Planned capital expenditures and disposals will affect cash flow.

- Analyzing Other Investments: Include any other planned investments or divestments in non-current assets.

D. Detailing Financing Cash Flow:

- Debt and Equity Transactions: The balance sheet will show any projected changes in debt balances and equity investments. This includes new loans, repayments, equity issuance, or buybacks.

- Dividend Distributions: If applicable, include planned dividend payments.

E. Reconciling to Net Cash Flow:

- Sum of Three Categories: The total operating, investing, and financing cash flows equals the net cash flow for the period.

- Matching Balance Sheet Cash Changes: This total should match the change in the cash account as projected in the balance sheet. If there’s a discrepancy, ensure all balance sheet changes are accurately reflected in the SCF.

F. Ensuring Accuracy:

- Double-check for Completeness: Confirm that the starting and ending balance sheets are complete and accurate.

- Account for Every Change: Make sure all changes in balance sheet accounts are included in the SCF, ensuring that it tells the whole story of your projected cash flow.

By following these steps, you can develop a budgeted SCF that not only projects your cash position but also aids in making informed financial decisions. Next, we’ll understand the direction of cash flows and the impact of different account movements on the SCF.

Related: Should Your Budget Be Flexible?

Clarifying Positive and Negative Cash Flows

In creating a budgeted Statement of Cash Flows (SCF), it’s essential to correctly identify which changes in balance sheet accounts represent positive cash flows and which indicate negative ones. Understanding these distinctions is critical to accurately projecting your business’s cash position.

Understanding Cash Flow Directions:

- Impact of Asset Accounts: Increases in asset accounts (other than cash) generally represent use of cash and, thus, are negative cash flows. Conversely, decreases in asset accounts indicate cash inflows and are positive.

- Influence of Liability and Equity Accounts: Increases in liabilities or equity typically mean cash is being generated, marking them as positive cash flows. Decreases in these accounts usually signify cash outflows and are thus negative.

Practical Examples:

- Asset Account Movements: For instance, if accounts receivable increase, it means sales are made on credit, not cash, implying a negative adjustment to cash flow. However, a decrease suggests cash collection, hence a positive cash flow.

- Liability Account Movements: An increase in accounts payable means more purchases are made on credit, delaying cash payment – a positive impact on cash flow. A decrease indicates payments are made, and so is a negative cash flow.

Cash Flow Directions and the Accounting Equation

Understanding the direction of cash flows becomes even more intuitive when considered in the context of the accounting equation (Assets = Liabilities + Equity). Remember that cash is an asset, and changes in this asset must offset changes in other accounts to maintain the balance in this fundamental equation.

For instance, when another asset account increases, say through the purchase of equipment or inventory, the cash asset account must decrease to keep the overall equation in balance, signifying a cash outflow. Conversely, when a liability or equity account is increased, such as securing a new loan (liability) or receiving additional equity investment, the cash asset account needs to increase correspondingly, representing a cash inflow. This direct relationship between the changes in asset, liability, and equity accounts and the resultant cash flow direction is a valuable concept in constructing a budgeted Statement of Cash Flows and understanding the broader financial dynamics of a business.

Understanding these principles is vital for accurately projecting how changes in your business operations, investment activities, and financing decisions will impact your cash flow. This clarity is essential for preparing a budgeted SCF for effective cash flow management and strategic planning.

Next, we will explore the significant value a projected statement of cash flows holds for managing and growing your business.

The Value of a Projected Statement of Cash Flows in Business Management

A projected or budgeted Statement of Cash Flows (SCF) is more than a financial document; it’s a strategic management tool that offers a glimpse into the future financial trajectory of your business. Here’s why it’s invaluable for managing and growing your enterprise:

Financial Strategy and Operations:

- Informed Decision Making: A projected SCF helps you anticipate future cash positions, enabling informed decisions on investments, expansions, and other significant financial actions.

- Cash Flow Optimization: It assists in identifying periods of cash surplus or shortfall, allowing for strategic planning in cash allocation and utilization.

Financial Stability:

- Risk Mitigation: By forecasting cash flow, you can identify potential financial risks early and take proactive steps to mitigate them.

- Liquidity Management: Regular cash flow projections ensure that your business maintains adequate liquidity to meet its obligations and avoid insolvency.

Growth Planning:

- Resource Allocation: Projected cash flows can guide where and when to allocate resources for optimal growth and return on investment.

- Funding Strategies: It helps plan for funding requirements through internal financing or seeking external capital.

Stakeholder Communication:

- Building Investor Confidence: A well-prepared projected SCF demonstrates a commitment to financial planning and transparency, enhancing investor and lender confidence.

- Internal Team Alignment: It provides a clear financial roadmap for your management team, aligning everyone towards shared financial goals and strategies.

Proactive Business Adjustments:

- Agility in Business Decisions: Regular updates to the projected SCF allow quick adjustments in response to market changes or internal business dynamics.

- Performance Monitoring: Comparing actual cash flows with projections helps monitor business performance and adjust strategies accordingly.

A projected Statement of Cash Flows is a powerful tool for any business, providing insights necessary for strategic planning, financial stability, and growth. It encourages proactive financial management, ensuring your business is well-prepared for the future.

Next, we will discuss key takeaways and additional resources to help you implement these strategies effectively in your business.

Conclusion

A well-crafted SCF budget sheds light on your business’s future health and guides decision-making and operational planning.

Key Takeaways:

- Forecast with Precision: The SCF allows you to forecast your cash position more accurately, providing a clear picture of future financial health.

- Strategic Decision-Making: Use the insights from the SCF to make informed decisions about investments, financing, and operational adjustments.

- Risk Management: Anticipate potential cash flow issues before they arise, enabling proactive risk management.

- Align Goals: The SCF helps align your team’s objectives and strategies with your business’s financial trajectory.

Implementing Your Budgeted SCF:

- Regular Review and Update: Continually revisit and update your projected SCF to reflect changes in the business environment and internal operations.

- Integrate with Other Financial Tools: Combine insights from the SCF with other financial statements and metrics for a comprehensive view of your business’s finances.

- Educate Your Team: Ensure your management team understands how to read and use the SCF for maximum benefit.

Additional Resources:

- Financial Management Software: Utilize tools that can automate the creation and updating of your SCF.

- Professional Guidance: Consult financial experts or accountants for in-depth analysis and advice.

- Educational Workshops: Participate in workshops or courses to deepen your understanding of financial planning and analysis.

By including the budgeted Statement of Cash Flows as a core component of your financial planning, you position your business for stability, growth, and long-term success. This proactive approach to financial management is critical to navigating the complexities of business finance, ensuring that your business remains resilient and adaptable in an ever-changing economic landscape.

Share with: